David Seropian fears a proposal to eliminate school property taxes across Pennsylvania would send McKeesport Area School District residents packing.

While the proposal — likely to be reintroduced in the state Senate within the next few weeks — vows to rid residents of their hefty school property tax bills and replace them with higher sales and personal income taxes, school districts across the state still could collect property taxes to pay off existing debt.

What does it mean? It means that in some districts, especially those with higher debt, residents could be paying nearly double in taxes until their local school district pays off its debt. In some districts, that will take more than 20 years.

“This is not tax relief for them. This is like piling taxes on to them,” said Seropian, business manager in the McKeesport Area School District.

And it’s hurting residents in some of the state’s least affluent districts, like McKeesport where the district is $106 million in debt due to past building projects, Seropian said. The district pays about $8.6 million a year to its debtors, yet receives about $10.7 million from local property taxes. The district operates on a $62.6 million budget, with about 65 percent of its revenue coming from the state.

If the proposal to eliminate property taxes gets the go-ahead from the state Legislature and Gov. Tom Wolf, residents in the McKeesport Area School District would be paying nearly 80 percent of their property taxes for the next 22 years, while still paying the added sales and personal income tax like everyone else.

“They’re going to be getting a double whammy,” Seropian said. “It makes no sense. It’s almost the reversal of who they ought to be helping – the districts that are less able to afford this kind of thing.”

The legislation, which Sen. David Argall (R- Schuylkill) said he plans to reintroduce to the state Legislature “any day now” is a “tax shift.”

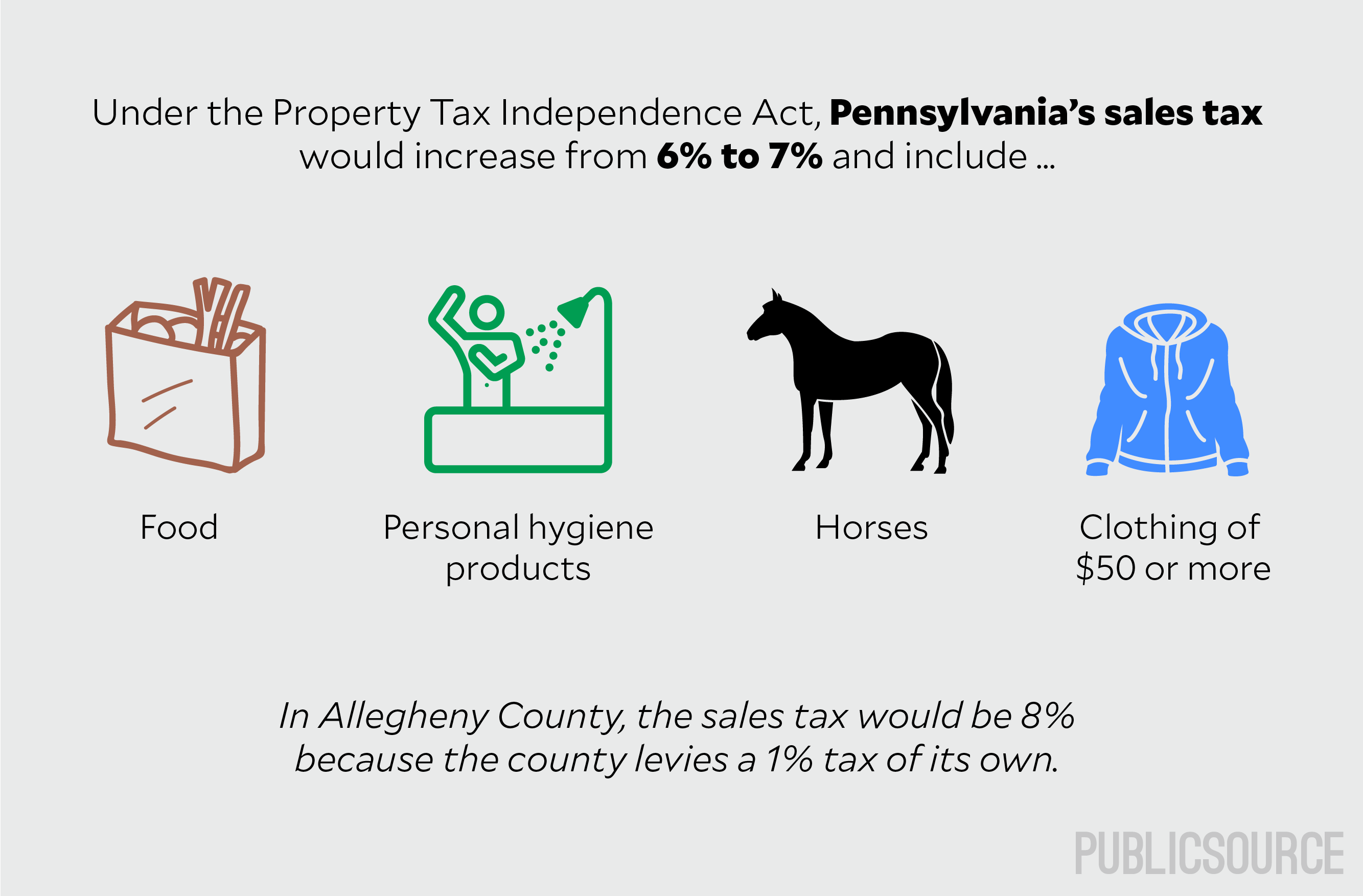

The $14 billion funding shift would include an increase in personal income tax from 3.07 percent to 4.95 percent. State sales tax also would increase from 6 to 7 percent under the proposal and expand to include items not currently included in Pennsylvania’s sales tax, such as food, personal hygiene products, horses and clothing when a garment costs $50 or more. Sales tax in Allegheny County, which has a 1 percent county sales tax, then would increase to 8 percent.

The legislation, deemed the Property Tax Independence Act, or Senate Bill 76, failed to pass the Senate when it received a 24-24 tie vote on Nov. 23, 2015. The lieutenant governor broke the tie against the bill.

With a shift in the Legislature, Argall said he’s hopeful the bill will pass this time around.

“The way that we’re funding the public schools today is rotten at the core,” Argall said. “It dates back to the 1830s. The world has certainly changed. We just can’t continue to fund the public schools based on this, outdated, archaic, unfair property tax.”

While eliminating school property taxes may sound simple, “The devil is in the details,” said Steve Robinson, spokesman for the Pennsylvania School Boards Association.

Concerns related to the proposal from school district officials across Allegheny County are vast: Will funding be stable? How will decisions be made? How can they pay for needed expenses? Will property taxes truly go away? And how can they make any major repairs to their buildings without what they see as a stable funding source?

How it came to be

David Baldinger, a retired radio personality and longtime television producer from Reading, has dedicated more than a decade to getting school property taxes eliminated in Pennsylvania.

“It’s been my full-time, unpaid job since September 2004,” he said.

Baldinger, who says he got involved for selfish reasons, at first, because he wanted to see his own property taxes go away, worked with his state representatives and senators in Berks County, sometimes sitting in their offices several days a week, to craft a bill he says would bring more fair taxes to all of Pennsylvania.

“Think of the other taxes that you pay, the income tax, sales tax. They grow over time as the economy grows. So you don’t have to raise the rate,” he said. “If you want more money out of the property tax, you’ve got to raise the rates and it’s killing people. They just can’t afford it anymore.”

Pennsylvania residents will pay an estimated $13.87 billion in school property taxes in 2016-17, based on a forecast done by the state’s Independent Fiscal Office in January. That number likely will jump to about $14.3 billion by the 2017-18 school year and $16.45 billion by 2021-22, the forecast shows.

Baldinger launched the Pennsylvania Taxpayer Cyber Coalition in 2004, one of the six founding groups of the Pennsylvania Coalition of Taxpayers Association. The association that now has 87 local tax groups from across the state supporting the effort. Baldinger says he can’t even count all the ways property taxes hurt Pennsylvanians.

“People can’t buy homes anymore because of the property taxes,” he said.

He tells the story of people that come to him, forced from their homes because they couldn’t pay their property taxes and their home was taken from them.

The coalition drafted the bill now known as House Bill/Senate Bill 76 and presented it to Argall in 2011, said Jon Hopcraft, Argall’s executive director. The bill required compromise on many issues, Baldinger said.

“If it was up to the Republicans, it would all be in sales tax. If it was up to the Democrats, it would all be income tax. We said, if we’re going to get this done, we’re going to have to compromise,” he said. “The best part is, you can’t lose your home. Nobody is going to take your house because you didn’t pay your sales tax.”

The issue has reached a “fever pitch” level in the eastern part of the state, Hopcraft said.

The senator said: “It’s the single largest issue in the district that I represent in Berks and Schuylkill counties. I can’t go anywhere in the district without someone asking me about it.”

He admits that Western Pennsylvania isn’t as caught up on the matter.

Under the proposal, school districts would receive the same amount they are collecting at the time of the bill’s passage from property taxes through the increased sales and personal income tax collection. The districts also would receive an annual adjustment for inflation that could equal a 2.5 to 4 percent increase each year in what they receive, Baldinger said. Money collected from sales tax and personal income tax would be distributed quarterly to the districts from an Education Stabilization Account that would not be impacted by the state’s general fund, he said. However, school officials said they worry the annual adjustments in funding could be impacted by fluctuations in income and spending habits.

Allowing districts to continue collecting property taxes to pay off their debts stemmed from a compromise made to move the bill along, Baldinger said. It’s only fair, he said, that the districts that racked up the most debt pay it off themselves.

Elimination could take years

Pennsylvania has 500 school districts. Residents in 488 of the districts would continue paying property taxes even if this bill to eliminate property taxes passes.

That irony is brought to you through an analysis of 2014-15 data by the Pennsylvania Association of School Business Officials [PASBO]. Essentially, the vast majority of districts have debts to pay off, so it could take years for residents to realize the benefits of the proposal.

Forty-three percent of the districts in the state would continue collecting at least 20 percent of their property taxes under the proposal, based on the PASBO analysis. In Allegheny County, 13 of 43 districts would continue collecting at least 20 percent of their property taxes, PASBO asserts.

“We’re looking at it as double taxation,” said Amy Burch, superintendent of the Brentwood Borough School District.

It’s been more than 20 years since the Brentwood Borough School District has made any major upgrades to its three school buildings, located in the heart of the 1.5-square-mile, single-town district, where students still walk the borough’s hilly terrain to get to class each morning.

Yet, the district still pays more than $1.8 million a year for past debt, including renovations and additions of all of the buildings in the 1990s.

“Do we think [we have] the perfect system? No. But the one thing was that it was stable. We could estimate from year to year what we were anticipating,” Burch said.

As Brentwood undergoes a feasibility study to review what upgrades are needed in the district’s three buildings, Burch said she worries about stable funding for improvements if this legislation were to pass.

The legislation would allow the Brentwood district to keep 22.23 percent of its current millage rate of 29.5332, or 6.5647 mills, to pay off its existing debt. The debt lasts until 2023. Residents would be required to pay that, plus the increased sales and personal income tax.

As it stands for 2016-17, the owner of a property of median value in Brentwood ($83,200) will pay $2,457 in school property taxes. Under the new plan, they would be responsible for about 22 percent of that (about $540) along with the increased sales and income taxes.

Brentwood has the second highest school property tax rate in Allegheny County, according to county records.

“I do not feel that that’s fair and I think that’s going to hit the middle class the hardest, which is what the Brentwood community is right now,” Burch said. “I’m concerned if they’re paying more at the cash register when they’re checking out that when it comes time to pay their school taxes that they might not have the money to be able to pay that as well.”

Residents in the Pittsburgh Public School District would continue to pay 32.14 percent of their school property taxes to pay off existing debt, per the PASBO analysis.

Residents in West Mifflin would continue to pay about 30 percent of their property taxes under the proposal, Superintendent Daniel Castagna said.

“It’s not going to be an elimination. It’s going to be a reduction. I think there are clear winners and losers in this, but the winners aren’t anybody who is working in the community. The clear winners are the retirees and the business owners, in my opinion,” Castagna said. He’s referring to the fact that seniors and businesses won’t be impacted by the increase in personal income taxes.

He fears, if passed, the legislation will chase residents from homes in districts that currently have more debt.

“What’s that going to do to families? That’s going to push them out of districts with debt service. It’s going to give them another reason to want to leave,” he said.

Castagna, too, worries the proposal would have a greater impact on students in poorer districts.

McKeesport Area School District would go from one of the lowest property tax rates in Allegheny County, at 16.74 mills, to one of the highest as it would still collect about 80 percent of property taxes under the proposal, Seropian said. In 2016-17, a resident with a median property value of $60,000 will pay about $1,000 in district property taxes. If they qualify for a homestead exemption, their bill will be reduced to $680.

“If you’re going to pay 80 percent of your tax bill in the McKeesport Area School District and only 20 percent somewhere else, where are you going to live? Why would you live here? I don’t even think they thought this through. It just doesn’t make any sense the way it’s designed with keeping the portion for the debt,” Seropian said.

How much Allegheny County school districts would still owe in property taxes under the Property Tax Independence Act

Source: Pennsylvania Association of School Business Officials analysis of 2014-15 property tax data.

Residents in the Duquesne City School District would continue to pay 100 percent of their property taxes while paying the added sales and personal income taxes if the proposal moves forward. PASBO’s analysis shows Duquesne’s debt payments equal 203.72 percent of what the district collects in property taxes.

Jeff Ammerman, director of member assistance for PASBO, said this is likely because the district receives a greater percentage of its funding from the state than local property taxes.

“It certainly varies greatly by district. Duquesne is an outlier,” Ammerman said.

Baldinger said school districts would not be allowed to collect more in property taxes than they are currently collecting to pay off debt. Under the proposal, districts would be required to declare all outstanding debt with the state on the bill’s date of enactment. That number, divided by the number of years of debt service remaining, would determine how much districts would be allowed to collect in property taxes to pay off the debt service, he said.

Will it pass?

The bill has come a long way since Baldinger began working on it nearly a decade ago, he said. The tie vote in late 2015 “woke some people up,” he said.

When it was announced earlier this year that the bill would be reintroduced in the state Senate, “It brought the cockroaches out of the nest,” Baldinger said. He called many of the concerns from school district officials “unfounded.”

Gov. Tom Wolf has met with advocates on both sides and plans to monitor the bill, along with any other proposed property tax reform, as it works its way through the Legislature, said J.J. Abbott, Wolf’s press secretary.

Wolf is focused on getting more state dollars to public education, Abbott said. While he supports property tax reform, he doesn’t want to see increased sales tax on food or clothing, he said.

“He’s in a place where he could be supportive of elimination. It’s just really how you get there,” Abbott said. “At this point, he just wants to have productive conversations with people, see what other ideas may be out there.”

While Baldinger says most Pennsylvania residents will end up paying less with the tax shift, local school officials are urging people to see if that’s true.

School officials in the region say they’re not sure if the bill will pass this time around, but if it doesn’t, they’re certain it will be back again for another try. They’re urging taxpayers to see for themselves if the proposal would be a benefit to them.

“It’s important that everybody runs their own numbers,” Castagna said. “Look at what the increase in the income tax is going to do to you. Look at your local district and see what your property tax reduction is going to be. I think for a lot of people they’re going to see this is not a win.”

PublicSource’s Interactives and Design Editor Natasha Khan produced the graphics for this story.

Stephanie Hacke is a freelance journalist in Pittsburgh. She can be reached at stephanie.hacke@gmail.com or on Twitter at @StephOnRecord.

The schools should have to live in a budget like every one else has to. and it is true there are a lot of people that have children going to school that are paying nothing and next to nothing. This is wrong. I am a senior and like so many other seniors must continue working because of the wrongful school taxes and I can say with all honesty that I have more than paid my dues while so many others are paying nothing. If the schools need extra money I say put the burden on the people that have children going to school.

Ad sales tax is even more fair, then the poor are paying their fair share too.

Unfortunately, that would allow commities to put in the more unfair per capita tax.

Yes, look at the source of this. Talk about self interest. And as for 8% sales tax in some areas try South Carolina 10% in some areas. Really ? This is the fox trying to convince the hens that they are veggin. They aren’t giving you accurate complete facts. Nor are they telling you the long haul effects of continued property tax system as it stands. Ever meet a politician or union official that willingly gives up a cash cow? You are their cash cow and the fodder is loaded with molasses to make it taste sweeter.

The debt claim is bogus. Watch video on this topic.

https://www.youtube.com/watch?v=3KK9jGhhKP0&t=214s

and

https://www.youtube.com/watch?v=3KK9jGhhKP0

I don’t personally have a problem paying my property taxes, increased income taxes or more in sales tax. Yes the property tax system in this state does need to be revised, but not completely done away with. I may be wrong but I always thought it helped pay for fire departments.

I don’t see any need to tax us for everything under the sun we don’t need to tax food clothing or personal hygiene that is a guaranteed way to make the welfare system that much worse in the state, and you will likely see many people forced out of their homes because they can’t afford all of these new taxes to compensate for the loss of a few.

I also feel that I should have to pay school district taxes when I have no children. If I had children I’d have no problem paying it because my kids would depend on the school system, no matter if it’s public or private. This school system is very broken and property owners are charged twice a year for school district taxes. When we pay our outlandishly expensive property taxes because of the schools and again when we file our income taxes. I feel that it is time to make all of these parents using this system for free to start paying into this system they use just as much if not more than those of us with no children are paying into a system we are not using.

I am sure many will disagree with this but it’s just my 2 cent’s. I’m am not here argue about who is right and who is wrong, I do not engage in such conversations nobody ever wins.

School districts with huge debt acquired that debt through poor planing and poor fiscal management. It is why it is very important to demand school boards be responsible with taxpayer money and be fiscally responsible in their spending. No more Taj Mahal schools, Olympic size pools, or multi million dollar sports complexes with AstroTurf! Now they will have to pay the piper. It is not fair for them to cry about it now and stop responsible districts from benefiting from school property tax elimination. It is time to take the power to tax away from irresponsible school boards and put them on a budget they must abide by. Property owners are not ATM’s for them to tap at will! NO MORE! End the school property tax. Pass House Bill 76 the Property Tax Independence Act!

That is a very good point. Now that you mention it, all the teachers I know that have retired have moved out of PA. Now that is thought provoking!

SEEK THE TRUTH: For those of you that have a FB account please like “PTCC” on FB. This is an umbrella organization of over 13,000 members from 84+ grassroots organizations that support SB76. This FB page is a fantastic resource to get educated and ask questions. If you do not have a FB account http://www.ptcc.us is another great resource.

grifhunter, please keep posting. You are one of the best things the bill has going for it. Your anti 76 comments make no sense. Correctly stated, you don’t deal with the questions of the discussions. You revert to lowlife name calling because you have nothing to offer. One can only conclude you are a sad excuse human being.

If I was a rookie and read this page your comments would scare me to the 76 side. GOOD JOB!

The students we pay so much to educate are also moving out of Pennsylvania after they graduate to find better jobs and more affordable housing.

“The benefit of property taxes is that they are more stable over time than sales/wage taxes”.

Yeah, and the benefit of slavery was that it was more stable labor force over time than hiring workers. But that didn’t make it the right thing to do, did it?

Property taxes are not stable. Many school districts have suffered the loss of properties and funding as businesses move or go bankrupt. Many people and corporations are now appealing their taxes and many win. GlaxoSmithKline won an appeal for millions of dollars that the school district had to struggle to recover. The assessment and collection system for property taxes is also expensive. The more property taxes increase the more the system will become unstable. Stability of property taxes over income and sales taxes is a fallacy.

At a recent Boyertown School Board meeting they were lamenting the loss of ONE bank property that was assessed at 600K. They were hoping someone would build four or five homes to make up for the tax loss. Stability, yeah, right.

Are you kidding ? Public workers in PA are making twice what they do in North and South Carolina . The PA Public workers are raking it in pensions also . The PW salaries always go up , the private sectors rarely . Why should we go broke paying high salaries for public workers and their pensions .

The teachers will all tell you once they get their pension they are leaving PA for a lower taxation state .

Public workers should never had been promised a percentage increase , regardless of what the markets paid out . Politicians curried favor with public workers to get elected .

Read the pension tsunami http://www.pensiontsunami.com/

People in the underground economy will pay every time they purchase something in 76 . Every bit of fast food, clothing , etc will be taxed. Better than what it is now – they don’t pay and their employer hides money from the jobs the undocumented do.

Yeah, I guess I could pick up a 4th job and move from my paid for (for 20 years) 2 bedroom house into the shed out back or a cardboard box on the street. You believe a family should do without food, meds, homeowners insurance (required in PA), healthcare, gas, electric, water or garbage to pay property taxes? Several families in our area have dropped phone service, cable and internet are selling items out of their homes to try and make ends meet. Please share your insight on how to further cut expenses – I am all ears. I am required by law to pay my property taxes which are very costly, as well as homeowners insurance! The taxpayers are going to pay a heck of a lot more to keep the thousands moving into section 8 housing.

U r a complete idiot don’t waste ur time here

Oh yeah, Hell yeah, I’ll move. you want to buy my house?

No one want to buy a house with 2 mortgages, one of which never stops going up! So I have to rearrange my life for someone pension. Where do come up with this nonsense.

“The benefit of property taxes is that they are more stable over time than sales/wage taxes”

So in hard times like the recession of 08 it would be ok for the school district to take my house. No problem I’ll be fine, I’ll just go find a nice cardboard refrigerator box to live in.

“allowing school districts to plan their budgets accordingly”

they already have for years to come, especially their PENSIONS!

“A school district operates under different financial constraints than a household.”

You got that one right, except for the word “constraints,” they have NONE! They sure don’t have a problem using the households credit card however!

“It’s hard to make multi-year investments and take care of fixed expenses such as teachers and facilities if a school board does not know how much money the district will have at a given time.”

Well maybe it’s time they learn how to budget like the rest of us, instead or relying on PA homeowners unlimited credit line!

“The long-term nature of these financial obligations makes it difficult to cut back expenses quickly. Even districts that plan their expenses prudently are likely to fall short during a recession and will not have a good way to estimate how much money to save during flush times to make up for future shortfalls.”

This is something for the state to

workout, homeowners just want out of this financial disaster!

“Eliminating property taxes shifts

the tax burden from wealthier property owners who make their money

from investments (already more favorably taxed than wages) to

working-class wage”

Pa ranks 38 out of 50 state in number of millionaires, there are 29.6 millionaires per one thousand people. And millionaires will still

have an increase in their wage tax like the rest of us!

“The regressive sales tax also hits people in the lower part of the income spectrum more heavily.”

No again your wrong, there are strict limits in place for food and clothing, be specific!

I could continue but I think you probably work as a teacher or school administrator so I’m probably wasting my time!

“making the working poor and middle class carry my load for me”, You don’t know what your talking about dude or dudette. Your really making yourself look stupid!

Did you even read SB76, or do you just think you know it all, sunny Cal?

Google “sugartitz”, but drop the “z” and use an “s”. Its usually perceived as a compliment by secure adults, but in your case……

https://www.netmums.com/coffeehouse/general-coffeehouse-chat-514/general-chat-18/934903-compliment-insult-all.html

Google “codger”, first result,

codg·er

noun, derogatory

an elderly man, especially one who is old-fashioned or eccentric.

“old codgers always harp on about yesteryear”

Google “derogatory”. I didn’t Google “shugartitz”, as you referred to me in an earlier post, care to explain that one?

But your posts are full of asinine mistakes, so you have no credibility. Codger is not an insult in any fashion: “An amusingly eccentric or grumpy and usually elderly man.” https://en.wiktionary.org/wiki/codger

“… codger(noun) used affectionately to refer to an eccentric but amusing old man”. Princeton Wordnet. http://www.definitions.net/definition/codger

You are so full of errors, yet your narcissism continues to blind you into repeating your bankrupt positions in every publication. Integrity? You might have some if you ever understood even in the slightest the definitions and meanings of things.

Enthusiastic supporter of “making the working poor and middle class carry my load for me”, is more like it. Sad.

That “codger nurse”, who I have met in person, served in the military and in his 50s became a registered nurse. Now he campaigns for tax reform. Just because his opinion differs from yours, is no reason for you to be insulting.

Besides, having you constantly responding to me is a public service, as it allows everyone to see the lack of integrity in some people who oppose property tax reform and as a last resort spew insults in hope of quieting those in favor.

I may be an enthusiastic supporter of property tax reform but at least I have more to say than just cutting and pasting the same comment.

You are the prolific poster, leaving your vile stink of an opinion across several sites. I’m the disinfectant. You stop, I’ll stop. Don’t forget you began by attacking me after I responded to the codger nurse in the daily times.

Besides, having you constantly responding to me is a public service, as it allows your poor husband a few moments of sweet relief from having to listen to the banal prattle you disgorge.

Your copy and paste tactic and only commenting on my posts qualifies you as a stalker and troll, there are 30 other posts in this and other threads with similar opinions to comment on, yet you choose only mine.

So much for decorum, Ms Hypocrite. Stalker? Troll? I made a valid- reason based factual counterpoint and you do the insult thing. Too bad, you were mildly interesting but for the insults.

Since you seen to be a stalker troll I’ll just link my reply to save some time.

http://thetimes-tribune.com/opinion/property-tax-idea-chancy-1.2179743#comment-3256140346

Now now Susan, you know its not true that only property owners fund

public education. The commercial property tax owners, ie landlords and

businesses pass on their property taxes in the form of higher prices or

rents to those citizens who don’t own a home. So, everyone is paying

in.

Susan, you need to come to grips that without property taxes,

those who deal in cash in the underground economy will pay NOTHING into

the school systems. At least with a property tax, everyone is carrying

the burden. http://www.nolo.com/legal-e…

Horrors, a broken basketball hoop and some tape on the carpet.

How about a photo of the 10,000 people a year who lose their home to property taxes.

A family has more flexibility than a school district. Family members can pick up an additional job when money gets tight. Families have more leeway to cut expenses because they aren’t required by law to provide a specific set of services, some of which are very costly. They can downsize to less expensive residences. Et cetera. The analogy just falls flat.

Furthermore, you are getting something for your school tax dollars– a reasonably literate and numerate society that educates its children well enough to provide a future workforce.

A family operates under different financial constraints than a school district. It’s hard to make multi-year investments and take care of fixed expenses such as utilities, building maintenance and food if a family does not know how much money the family will have at a given time. The long-term nature of these financial obligations makes it difficult to cut back expenses quickly. Even families that plan their expenses prudently are likely to fall short during a recession and will not have a good way to estimate how much money to save during flush times to make up for future shortfalls. Therefore it is prudent for the state to take their home when families fall short? If more money is taken yearly from families, it is only a matter of time until they are out on the street. In current economic times, the average worker is paying double for healthcare and more for everyday expenses. There is less money in people’s pockets, yet the homeowner is expected continually pay more and more. It has to stop.

I live in Allegheny County. As a wage earner who fills out a 1040 form for my federal taxes, I cannot deduct my school property taxes because my home has been paid for, for many years. We bought a home we could afford and budgeted accordingly. It is time for school districts to stop killing homeowners and PA. They should have to stay in budget as families are expected to. Wouldn’t it be nice if we could just raise our credit limit on our credit cards when times are tough and not have to account for it or pay it back? Just raise the limit again when there is a recession or when times are tough.

To join the fight visit http://www.PTCC.us and over 13,000 members of our facebook page Pennsylvania Tax Cyber Coalition. We need to start spreading the truth and get property taxes eliminated.

According to your own logic. The districts with higher property values. Can charge less. But by the very fact the higher values. They pay more inherently This will produce like amounts of funding as other districts. Nice try though. We all know this rich sons of bitches aren’t paying their fair share right ?

When you say ‘send them packing’ you mean they will finally be able to afford to go on vacation??

Wow, pile on the scare tactics. Property taxes to fund school districts was a dream of Dr. Benjamin Rush and he died in 1813. It’s time to find a different way to fund public education. The system is broke. We don’t live on farms and the size of our property doesn’t dictate the size of our wallets. Increasing sales tax and income tax will spread the tax base over every person in PA, not just homeowners. The more you make and spend the more you pay. When you retire and you make less and you buy less, the less you pay. Seems more fair if you ask me.

Maybe districts will have to actually control their spending and find revenue sources such as education foundations. There’s a novel idea. Oh, and the state, well they will have to stop making retirement promises they can’t keep and then hitting up the homeowners. No tax should have the ability to take away your home in order for the teacher to retire. This change is way overdue.

For the truth, go to http://www.PTCC.us

The property tax is the most unfair, and destructive way to fund the public school system imaginable. It guarantees poor communities will have crappy schools, and rich communities will have good schools. Thats flat out WRONG. It also has lots of unintended consequences ranging from forcing elderly residence out of their homes, and discouraging property improvement. This without having to mention that the mechanism for property valuation is, unfair, expensive, and totally broken.

Income tax is a fair, progressive way to fund education. Let’s do it.

My district slammed through new building and repairs , refinanced for 30 years. All without any taxpayer approval. I think the state should be on the hook for that from all this increased revenue.

The bill freezes the current debt and the portion of the property taxes permitted to continue temporarily CAN ONLY BE APPLIED TOWARD PAYING OFF THAT DEBT. If the school board wants to they can pay more from their budget, from selling buildings no longer used, etc.

The only way they can RAISE TAXES TEMPORARILY is by getting local taxpayers to OK a LOCAL income tax for:

1. A specific reason, and

2. A specifc rate, and

3. To raise a specific amount, and

4. Withba specific drop dead date when the tax goes away.

If used for General Purposes the public gets to vote every 4 years as to whether to renew the tax.

There is absolutely nothing to stop them from continued refinancing more debt. As a property owner. We all know how those blank check increases. In property taxes every year continue non-stop.

The benefit of property taxes is that they are more stable over time than sales/wage taxes,

allowing school districts to plan their budgets accordingly. A school district operates under different financial constraints than a household. It’s hard to make multi-year investments and take care of fixed expenses such as teachers and facilities if a school board does not know how much money the district will have at a given time. The long-term nature of these financial obligations makes it difficult to cut back expenses quickly. Even districts that plan their expenses prudently are likely to fall short during a recession and will not have a good way to estimate how much money to save during flush times to make up for future shortfalls.

Eliminating property taxes shifts the tax burden from wealthier property owners who make their money from investments (already more favorably taxed than wages) to working-class wage

earners. The regressive sales tax also hits people in the lower part of the income spectrum more heavily.

I live in Allegheny County. As a wage earner who fills out a 1040 form for my federal taxes, I can deduct my school property taxes — which are easy to keep track of. With sales taxes, this task becomes much harder. I’ll still have to pay property taxes to the county and borough where I live, so it’s not as if they are going away. My school district charges a wage tax on top of a property tax, which also isn’t going to go away. And I’ll have to pay far higher sales taxes on a wider variety of items, including necessities like food and clothing. I just don’t see my tax burden easing with this plan.

Getting the majority of school district funding from the state seems like a good idea on the surface, especially for poorer districts. The problem is that we can’t trust our state senators and reps in Harrisburg to do the right thing and fund our public schools properly. Our school children will be at the mercy of ideological lawmakers who oppose public education and want to replace it with religious, private and for-profit schools. And these folks are difficult to defeat in elections due to Pennsylvania’s extreme gerrymandering.

Having said that, the property tax system clearly needs reform. Older residents on fixed incomes are hit particularly hard by them. School districts with falling property values get stuck in a death spiral that plunges them deeper in debt, and few have any appetite for the school district mergers that would help to alleviate this problem. Increasing the state wage tax to reduce property taxes for low-income and older Pennsylvanians — for instance, by greatly increasing the homestead exemption and giving property tax relief to lower-income residents — would help to address some of these problems.

With 65% of its revenue coming from the state, McKeesport has been subsidized for YEARS by the rest of Pennsylvania. They want it both ways – high state subsidies for their district and the status quo for the rest of us where local taxes fund 70% or more of our district budgets. Seropian simply underscores the obvious: his district doesn’t have the tax base to support public education, but that doesn’t stop them from racking up more than $100 million in long-term debt. He and others like him will hang on to the status quo with a death grip. Unfortunately, the other hand is choking the life out of his district while he argues against relief to the rest of us.

I don’t care if I have zero reduction in my overall school taxes. But the current property tax system is broken and needs to be changed. I’m tired of paying property tax rent on my home and I’m not even retired yet. Removing the school property tax will benefit all of Pennsylvania by attracting business and good jobs. So what if my school district debt isn’t retired for years, at least the end is in sight and future generations will benefit. If we don’t stop school property tax now it will continue to skyrocket . . . forever.

The Property Tax Independence Act is only meant to Eliminate the SCHOOL PROPERTY TAX and was never intended to include the much smaller Municipal/county property tax. SO isn’t it interesting how the PSEA or the School Board association INCLUDES these OTHER property taxes in their calculations to INFLATE the figures and fool the public.

In our district teachers are about ready to go on STRIKE if they don’t get a 6% salary increase each year for 4 years…totaling 24%. Are YOU KIDDING ME?

Who Has the COCONUTS to demand A Salary Raise LIKE THAT? Not only does that raise The budget item for salaries by 24%, but it raises the districts Pension costs , its workmans compensation insurance costs, its life insurance premium costs ( based on salary) by 24% as well.

The teachers pension has gone $7 BILLION FURTHER in the hole this past year and now totals over $50 BILLION. Divide that by 500 school districts and it averages $100,000,000 of debt per district which Harrisburg has spread out for 30 yesrs or more. What is really upsetting is that HARRISBURG SAW THIS COMING IN 2004 and just keeps kicking the can down the road and allowing things to get worse. They MUST BE FORCED TO FIX THE PROBLEM and ELIMINATION will do that.

Most do not know that if the TEACHERS UNION screws up as they have the kast three years, AND DOES NOT AVERAGE a 7.5% profit on their investment pool THEN SCHOOL DISTRICTS ….must RAISE Property taxes To make up the difference. PENSIONS are one of the Exceptions that districts can raise taxes for without a voters Referendum. How Convenient!

So if your investments are bottoming out, you may have to cash them in AND TAKE A LOSS, to pay your property taxes….so the TEACHERS PENSION POOL profits enough. Something is wrong with this picture!

I am one a of a team of folks going door to door all across PA. By an overwhelming majority the souls behind those doors are desperate for 76 to be enacted.

The anti 76 talking points are all riddled with misinformation. SEEK THE TRUTH: For those of you that have a FB account please like “PTCC” on FB. This is an umbrella organization of over 13,000 members from 84+ grassroots organizations that support SB76. This FB page is a fantastic resource to get educated and ask questions. If you do not have a FB account http://www.ptcc.us is another great resource.

Look at the first line “David Seropian fears a proposal to eliminate school property taxes across Pennsylvania would send McKeesport Area School District residents packing.”

Now google search “home foreclosures McKeesport PA” and you’ll find 2,103 results. Residents have already been packing because they’re being forced out of their homes.

And that line about 76 “the devil is in the details” …the school property tax is the devil.

Why doesn’t the data show other counties regarding how much we’ll still have to pay in school property taxes due to school district debt? Ours, ASD is approaching one hundred million. Regarding article content – “He admits that Western PA isn’t as caught up on the matter.” Yes, we are! We have senator Don White championing school property tax elimination. And, “However, school officials said they worry the annual adjustments in funding could be impacted by fluctuations in income and spending habits.” Welcome to our world. Learn how to cut back spending when your income decreases. How about that?